Top Real Estate Trends for 2025 in the Kitchener-Waterloo Market

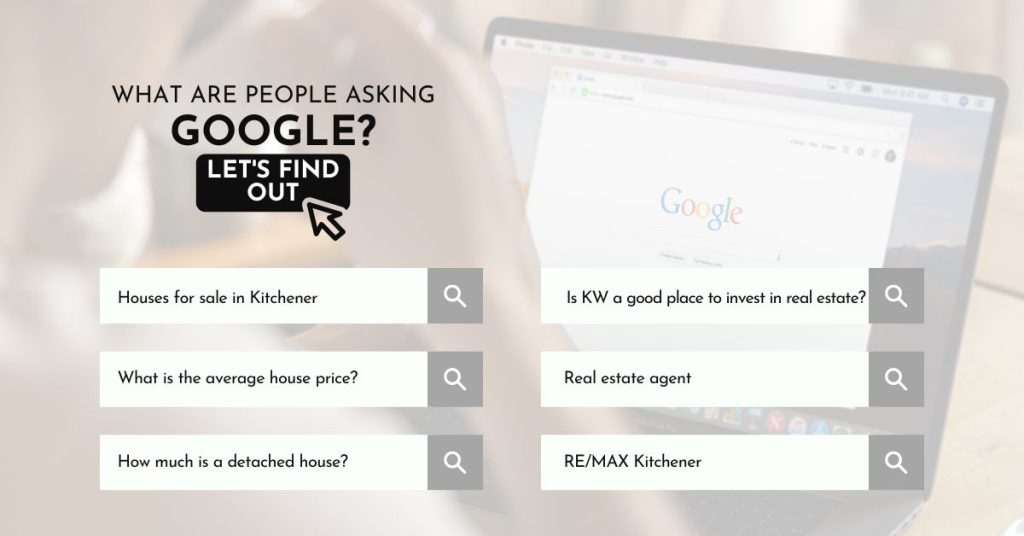

The Kitchener-Waterloo real estate market is set to undergo further transformation in 2025. Our region is known for its robust tech sector, vibrant cultural scene, and strong educational institutions, and it continues to attract buyers, investors, and developers.

But first…

Before we dive in too deep, let’s jump into 2025 interest rates. The big question on everyone’s mind is “Will interest rates go down in 2025?”

2024 started out with a Bank of Canada interest rate of 5.00% and as of December 2024, there have been 5 consecutive decreases. June, July and September saw decreases of 0.25%, and then in an announcement on October 23, 2024, the Bank of Canada announced the first 50-basis-point cut since the pandemic. With the October 2024 cut, the interest rate was 3.75%.

The final announcement of 2024 came on December 11, in which the Bank of Canada delivered the 5th interest rate cut (and the second consecutive half of a percent cut), landing the rate at 3.25%.

The immediate impact of a lower interest rate is that homeowners with variable-rate mortgages could benefit from much-needed relief through lower interest rates and reduced monthly payments. It is also impactful for homeowners renewing their mortgages, Canadians looking to secure a mortgage, and those with home equity lines of credit (HELOCs) and personal lines of credit.

Interest rate announcements from the Bank of Canada will be made on the following dates in 2025:

- Wednesday, January 29

- Wednesday, March 12

- Wednesday, April 16

- Wednesday, June 4

- Wednesday, July 30

- Wednesday, September 17

- Wednesday, October 29

- Wednesday, December 10

Interest rates do have an impact on the real estate market, but here’s a look at other top trends that are expected to shape the KW real estate market in 2025:

1. Updated Rules Helping Buyers

First-time home buyers and those purchasing newly built homes now have the option of a 30-year amortized mortgage, which can significantly reduce monthly payments. This extended amortization period makes it easier for buyers to manage their finances and secure a home that fits their budget.

In addition, the Canada Mortgage and Housing Corporation (CMHC) has increased the price limit for insured mortgages. Previously, any property costing $1 million or more required a 20% down payment, making it challenging for some buyers to afford higher-value properties. Now, this threshold has risen to $1.6 million, enabling a broader range of high-end buyers to purchase homes with a smaller down payment. This change could open up opportunities in competitive markets, making higher-value homes accessible to buyers who may have been priced out previously. These adjustments reflect efforts to improve housing accessibility and affordability amid rising property values across Canada.

2. Continued Growth in the Tech Sector and Its Impact on Real Estate

Kitchener-Waterloo has earned a reputation as Canada’s “Silicon Valley North.” With tech giants like Google and Shopify, along with a thriving startup ecosystem, the region continues to attract a highly skilled workforce. This influx of tech professionals has created sustained demand for both residential and commercial real estate.

In 2025, expect to see more tech companies establishing their presence in KW, which will drive demand for office spaces, co-working facilities, and residential units. The influx of tech professionals could lead to higher property values in areas close to tech hubs like the Innovation District in Kitchener and the University of Waterloo.

3. Rise of Hybrid Workspaces and Co-Working Hubs

The pandemic brought significant changes to how and where people work, and these shifts have had a lasting impact. The hybrid work model, which combines remote and in-office work, has become the norm for many businesses. In 2025, this trend is expected to persist, influencing the design and functionality of commercial spaces in KW.

In 2025, we could see more co-working hubs popping up, especially in areas like Uptown Waterloo and Downtown Kitchener. These spaces cater to remote workers, freelancers, and small businesses looking for flexible, short-term office solutions. Developers and investors are also likely to explore mixed-use buildings that combine office spaces with retail and residential units, creating dynamic urban hubs.

4. Sustainability and Green Building Practices

Sustainability has become a priority for many buyers, tenants, and developers. In 2025, green building practices will be more prominent in the KW real estate market. With increased awareness of climate change, there is a growing demand for energy-efficient homes, eco-friendly office spaces, and sustainable urban planning.

New developments could incorporate features like solar panels, green roofs, rainwater harvesting systems, and energy-efficient appliances. Green building certifications such as LEED (Leadership in Energy and Environmental Design) will also become more common, as developers aim to attract environmentally conscious buyers and tenants.

5. Increased Demand for Affordable Housing

While KW has seen a surge in housing demand, affordability remains a challenge for many residents. The rapid rise in home prices over the past few years has made it difficult for first-time buyers and low- to middle-income families to enter the market. In 2025, affordable housing could continue to be a critical issue.

To address this, expect to see more initiatives aimed at increasing the supply of affordable housing. This could include government incentives for developers, partnerships between municipalities and developers, and innovative housing models such as modular homes and micro-apartments. Affordable rental units, especially in areas with easy access to public transportation, will also be a key focus.

6. Expansion of Transit-Oriented Developments (TODs)

Transit-oriented developments (TODs) are mixed-use developments that are centered around public transit hubs, offering easy access to trains, buses, and other forms of transportation. With the ongoing expansion of the ION LRT system and improvements to regional transit, KW is becoming a more connected region.

In 2025, TODs will be a significant trend in the KW real estate market. Developers are likely to focus on building residential and commercial projects near LRT stations to attract residents who prioritize convenience and accessibility. These developments will appeal to young professionals, students, and retirees who seek a car-free lifestyle.

7. Boom in Student Housing Market

With the presence of renowned educational institutions like the University of Waterloo, Wilfrid Laurier University, and Conestoga College, KW is a magnet for students. The demand for student housing remains high, and this trend is expected to continue in 2025.

Developers are keen on building purpose-built student accommodations (PBSA) that offer amenities such as Wi-Fi, study areas, fitness centers, and communal spaces. Investors are also showing interest in this sector, given the consistent demand. Student housing projects are likely to see an increase, especially in areas close to campuses and along major transit routes.

8. Growing Popularity of Suburban and Rural Properties

The desire for more space and a better work-life balance has led to a growing interest in suburban and rural properties. While the urban centers of Kitchener and Waterloo remain popular, more buyers are considering nearby towns like Cambridge, Breslau, Baden, and Elmira, where they can find larger homes, bigger yards, and more affordable prices.

In 2025, the trend of moving to the suburbs will continue, driven by remote work flexibility and the desire for a quieter lifestyle. Developers are likely to respond by building more family-friendly communities with amenities like parks, schools, and shopping centers. Additionally, larger properties with home offices and outdoor spaces will be in high demand.

9. Increase in Condo Developments

While single-family homes remain a popular choice, the rising cost of detached houses has led many buyers to consider condominiums. Condos offer a more affordable entry point into the real estate market and often come with added benefits such as maintenance services, security, and shared amenities.

In 2025, expect to see more condo developments, especially in urban centers like Downtown Kitchener and Uptown Waterloo. Developers are focusing on creating attractive, modern condos with amenities like rooftop terraces, fitness centers, and communal workspaces to cater to a diverse range of buyers, from young professionals to retirees.

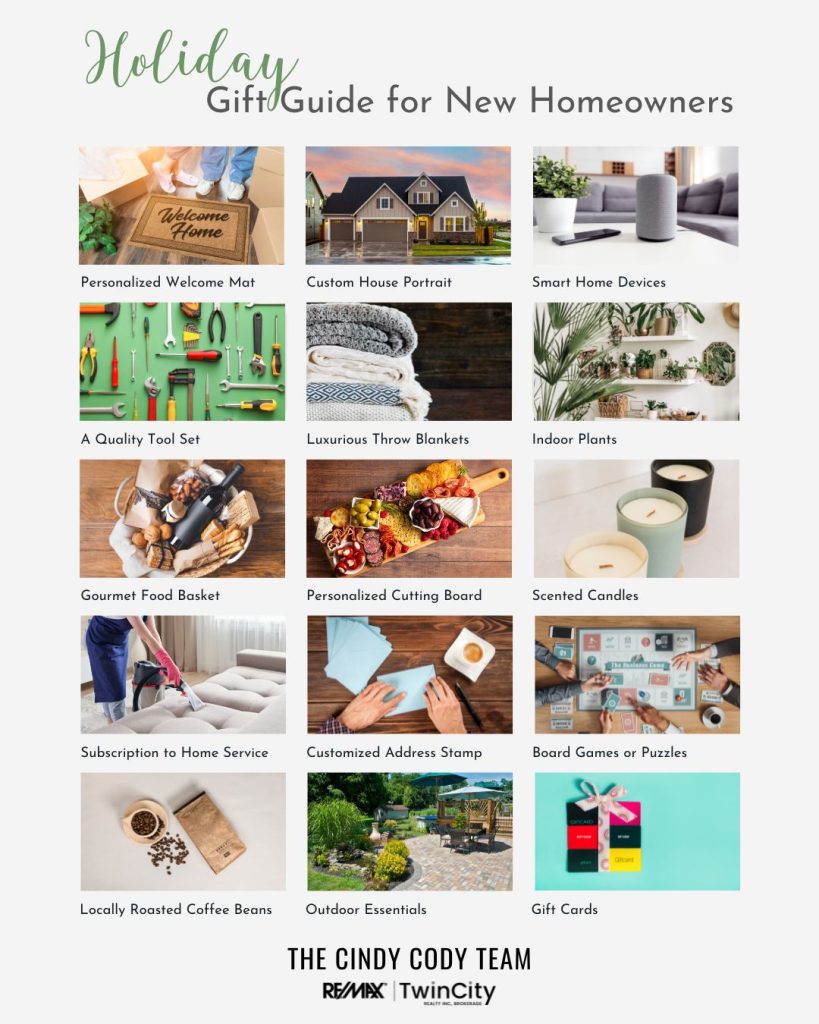

10. Smart Home Technology Integration

As technology advances, smart home features are becoming increasingly popular among buyers. In 2025, smart home technology will be a standard feature in many new developments across KW. Homebuyers are looking for homes that offer convenience, security, and energy efficiency, and smart devices help meet these needs.

Developers may be integrating smart thermostats, lighting systems, security cameras, and home automation systems into new builds. These features not only enhance the living experience but also contribute to energy savings, which aligns with the growing emphasis on sustainability.

11. Emphasis on Community Living and Wellness

The pandemic highlighted the importance of well-being, and this has influenced real estate trends. In 2025, there will be a greater focus on creating communities that promote wellness. This means building neighborhoods with green spaces, walking paths, fitness centers, and community gardens.

Developers are also focusing on creating spaces that encourage social interaction, such as communal lounges, outdoor gathering areas, and shared amenities. The goal is to build communities that offer a sense of belonging, safety, and a higher quality of life.

The Kitchener-Waterloo real estate market is dynamic and continues to evolve to meet the changing needs of residents, businesses, and investors. As we head into 2025, trends like the growth of the tech sector, sustainability, affordable housing, and smart home integration will play a significant role in shaping the market. Whether you are a first-time homebuyer, an investor, or someone looking to relocate, understanding these trends can help you make informed decisions in the KW real estate market.

Have questions about the market?

We’re here to help and guide you through the market. Don’t hesitate to reach out with any questions you may have.

Contact us today!

sold@cindycody

517-746-5136